Place-Based Investing and Opportunity Zones: Looking Back, and Looking Ahead

“Most people overestimate what they can do in one year, and underestimate what they can do in ten years.”

-Bill Gates

It was just over two years ago on this blog that we announced that we would be exploring a place-based investment platform focused on Opportunity Zones, and over a year ago, we announced Blueprint Local, which has become, according to Forbes, one of the top impact-focused Opportunity Zone investors in the country. In the subsequent year, significant shocks ranging from the global pandemic caused by COVID-19, and to the high-profile systemic injustices that the deaths of George Floyd, Breonna Taylor, and so many others have devastated our cities and communities.

The initial inspiration for Blueprint Local, a platform for investment capital to achieve attractive returns and meaningful community impact, came from a project in Access Ventures’ home neighborhood of Shelby Park in Louisville, Kentucky. Five years ago, a group of investors funded workforce-affordable housing, commercial real estate redevelopment, and small and local businesses in a historically distressed neighborhood—an investment that, five years later, has yielded thoughtful and positive growth. As one example, there has been an increase of 37% in home value—positive for existing residents and investors—while at the same time, an 8% decline in rent as a percentage of income, illustrating one way that an investment in a growing neighborhood can be done inclusively.

Blueprint Local has taken this “Blueprint” to focus on cities, investing in projects such as the redevelopment of historic Penn Station in Baltimore. We remain optimistic that leaders practicing “one-pocket investing”—investing that seeks to intentionally align successful and sustainable financial returns with meaningful community impact—can make an outsized difference. Yet change is hard and complicated. As we look towards the 2020 election and beyond, we felt the time was right to take stock of Opportunity Zones: both looking back and looking ahead.

Renderings of the new Penn Station-Baltimore

Opportunity Zones: What’s working?

The “Stone Soup” effect: unlocking existing assets in communities.

The Opportunity Zone tax incentive has transformed and significantly increased interest in community investment. We’ve been in hundreds of meetings across the country around thoughtful investing in communities that would have never happened prior to the Opportunity Zone story. There is an old folk tale, “Stone Soup,” where hungry strangers convince each household in town that seemingly has no food to each share their resources in creating a stew for the village, creating a feast for all; the town had far more resources than it thought it did. While the Opportunity Zone tax benefit is meaningful, it is not enough to cure decades of dis-investment. Positively, however, there has been a “Stone Soup” effect in cities across the country. As one example, over 100 cities have developed “Opportunity Zone” prospectuses in partnership with Accelerator for America, identifying and prioritizing key city investment priorities. We believe conversation never would have happened without Opportunity Zones.

At the same time, OZs are bringing new money to the table.

To make projects work, it requires successful collaboration. Take the example of the Penn Station-Baltimore project. For over twenty years, different groups have attempted to redevelop Penn Station. We have been proud to partner with Brown Advisory, a global investment and strategic advisory firm in a joint venture to mobilize private capital in Baltimore and elsewhere. The final recipe of the redevelopment is a stack of federal government involvement (Amtrak), the State of Maryland (historic tax credits), the city of Baltimore, and private Opportunity Zone investors. The Opportunity Zone incentive has given each of these actors the patience and focus to execute on this project.

We are most excited where we see collaborations that can bring together multiple groups of capital in one pocket: for example, earlier this year we announced a collaboration with Opportunity Alabama, a statewide economic development nonprofit, to bring together private investor capital as well as large corporations, such as Alabama Power, to invest with impact in their home state. A fund whose work we admire, Arctaris, has partnered with the Kresge Foundation to create a credit guarantee for investors that de-risks private capital that has not been at the table before. The Opportunity Zone incentive has caused traditional “two-pocket” investors to view new opportunities differently, and that is helpful. We are looking forward to developing and announcing more “one-pocket” collaborations in upcoming weeks.

The growth of “Zoomtowns”—and how OZ investment can play a role.

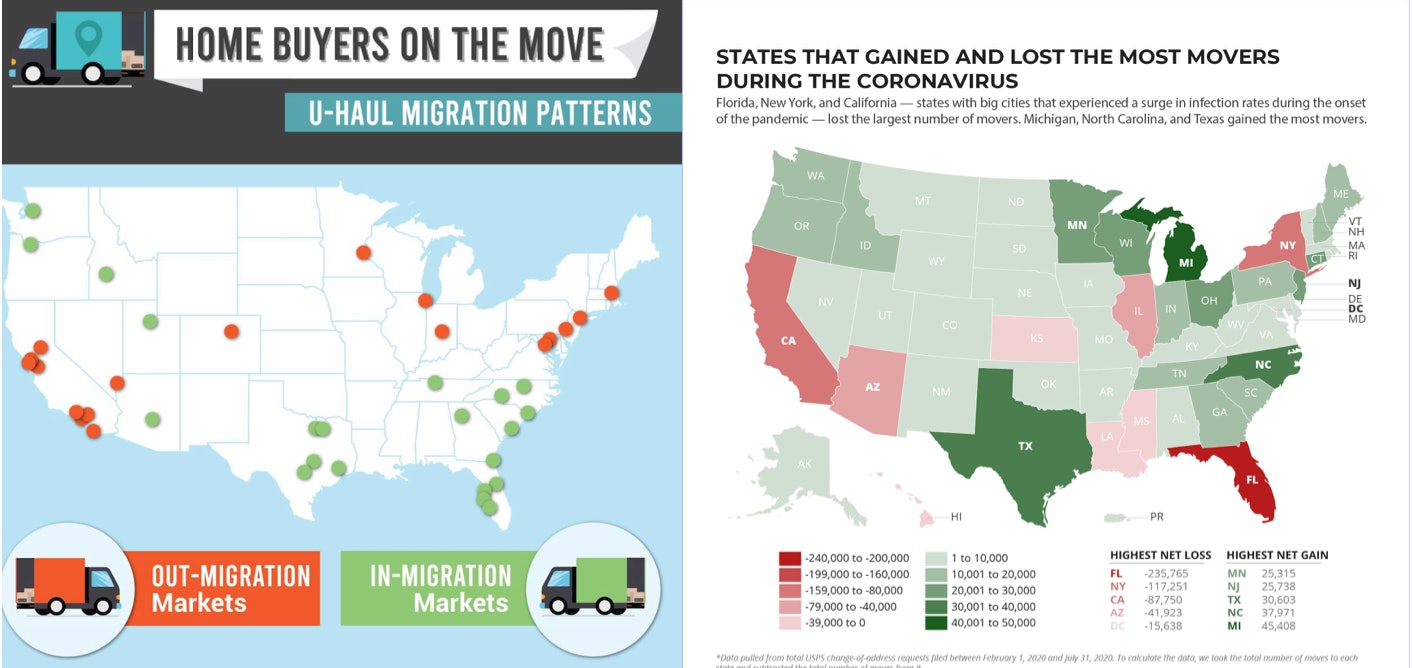

Even prior to COVID, we had been actively searching for and investing in what AOL co-founder Steve Case calls the “Rise of the Rest,” cities outside of major coastal money centers that are experiencing population growth. Post-COVID, we have seen many of these rising cities turn into “Zoomtowns,” where remote work is increasing the attractiveness of cities with natural beauty, amenities, and high quality of life. We have been active in cities from San Antonio, TX (2nd fastest-growing city in the US) to Greenville, SC (4th fastest-growing city in the US) to Raleigh-Durham, NC (highest net inflow of one-way U-Hauls, according to the company), where we see positive growth tailwinds but at the same time, a severe shortage of workforce and affordable housing opportunities. The growth of Zoomtowns can be great for these cities but making sure growth happens responsibly is a big financial and impact opportunity for investors.

Source: U-Haul (left); MyMove and USPS data (right)

Opportunity Zones: What’s missing?

The expectations game: the opportunistic projects are easy; the transformational projects are hard.

As Bill Gates observed in the quote at the beginning of this blog, “Most people overestimate what they can do in one year, and underestimate what they can do in ten years.” The New York Times has highlighted stories of bad-faith actors who have taken the incentive opportunistically, financing projects that are not within the intent of the legislation. Any program will have good and bad actors; unfortunately, the high-impact projects are almost always more complicated and take more time. Our hope (more on this below) is that revisions to the program are able to weed out the bad actors while still encouraging the good work that continues.

COVID has created heavy headwinds in many aspects of Opportunity Zone investing.

The crisis caused by COVID-19 has hit America hard, and has hit poor neighborhoods especially hard. 100,000 small businesses are going out of business each month. According to one survey, 41% of Black-owned businesses are hit hard by COVID. In the real estate market, hospitality, a major employer in distressed neighborhoods, are hit hard, and the future of investing in offices, typically necessary to bring good jobs to neighborhoods, is uncertain. In some cities, such as Austin, Texas, momentum continues (Tesla just announced their new GigaFactory near the East Austin Opportunity Zone where we have been active), but others struggle.

Opportunity Zones and operating businesses—have not found the right path yet.

My experience leading Village Capital, the organization I co-founded, led me to excitement about Opportunity Zones; Village Capital has supported over a thousand entrepreneurs worldwide over the past decade, many of the U.S. businesses in Opportunity Zones. Like many, I was excited that the OZ incentive could bring more capital to businesses. But a combination of regulatory uncertainty and investor engagement has seriously undercapitalized businesses—according to Novogradac, only 4 percent of Opportunity Zone funds focus on businesses. With the small business crisis post-COVID across the country, we have several ideas in the works to help bring more capital to businesses, but it has been an uphill challenge.

The nearly-finished Current mixed-use project; food entrepreneurs at Hatch Kitchen. Photo credit: Richmond Times-Dispatch

The 2020 Election and What’s Next

The vast majority of news is focused not on economic development or real estate investing, but the Election of 2020. While we’re not political pundits, we are watching the news closely. How do we anticipate the 2020 election will change Opportunity Zones?

Opportunity Zones in a Biden vs. Trump administration

We anticipate that a scenario where Republicans hold the White House will change very little about Opportunity Zones. Though the Opportunity Zone program has enjoyed broad bi-partisan support, the current administration has prioritized Opportunity Zones as a key pillar of economic development and we anticipate that these will continue.

In a scenario where Joe Biden wins the White House and there is a “Blue Wave” that leads to Democratic House/Senate/White House sweeps, we see scenarios where there may be changes:

– Changes to the Opportunity Zone program itself. Joe Biden recently expressed support for the Opportunity Zone program itself, yet highlighted that in some cases the intent of the legislation has not been met. He has proposed keeping the program intact, with three potential changes: (1) incentives for Opportunity Zone funds to partner with community organizations; (2) higher impact reporting requirements; and (3) transparency and public disclosure on projects. We believe these changes, if implemented well, could accelerate “one-pocket” partnerships while weeding out the bad actors, so we are watching closely.

– Changes to capital gains tax rates more broadly are heavily in discussion for any new tax plan. We believe an increase in capital gains rate may actually increase interest in Opportunity Zones, as the tax benefit would be disproportionately successful, which increases urgency all the more for high-quality funds, projects, and partnerships to grow.

What’s Next

We are actively exploring new opportunities, projects, programs, and partnerships based on what we are learning, and we would love to hear from you, whether you are an investor, a developer, an entrepreneur, a community leader, or just want to learn more. Please visit us at blueprint-local.com and we will keep you posted!