Lenderfit: Speed and Portfolio Growth

Time is money. And when you are running a small business, this is especially true. Lenders know this. But in a world of technological advancements—a world in which you can hail a ride with your smartphone or find a long lost friend in seconds—the process of obtaining a small business loan should be more intuitive for lenders and small businesses alike. Lenders and their small business client should be able to interact in ways that are as seamless as sending a message on your favorite app.

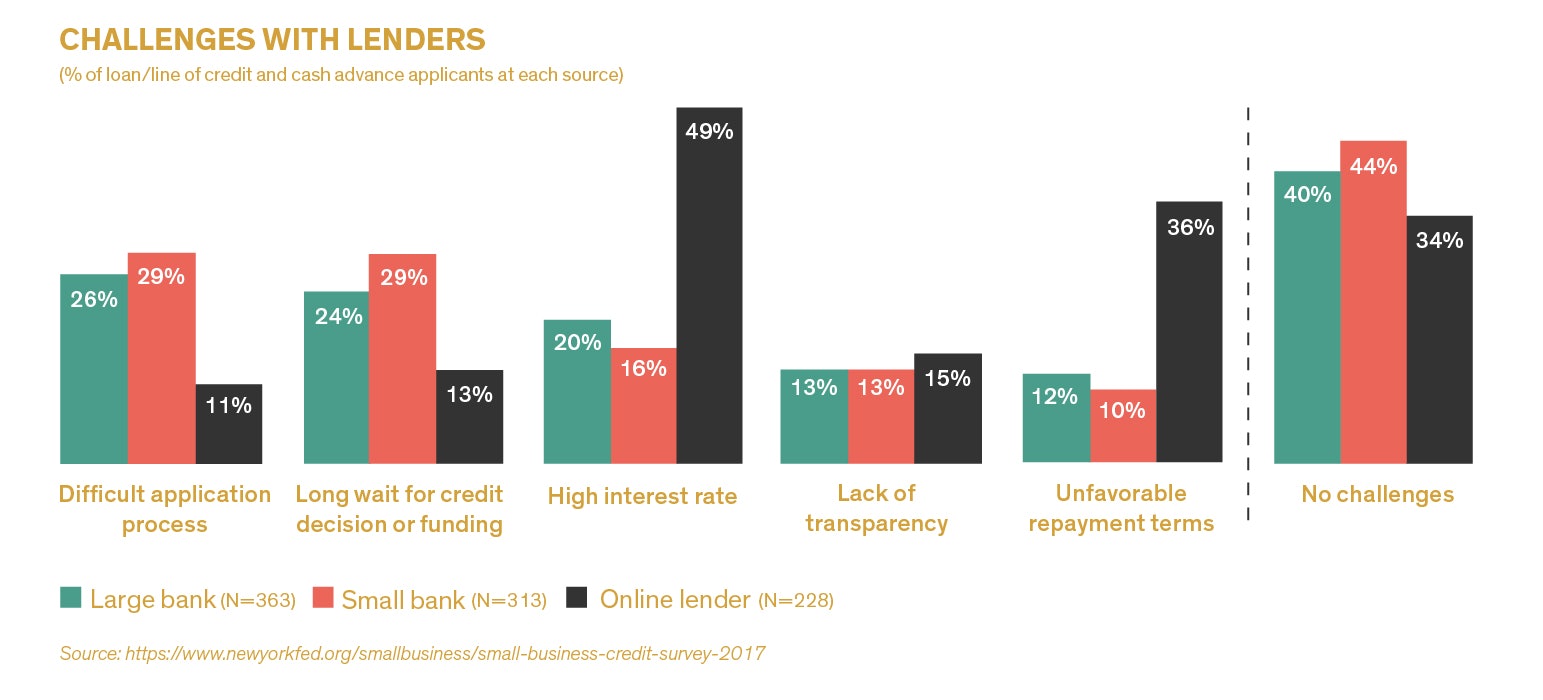

While many Lenders adopted more advanced methods for prequalification years ago, the process of collecting essential documentation from small business owners in order to verify the details of their application is quite old fashioned. This lack of modernization is costly on multiple fronts. As processing time increases, so do lender expenses, not to mention client frustrations due to an outdated experience. Meanwhile, small business owners must make sense of faster products that are ultimately far more expensive. Do they wait six weeks for a possible no, or pay a hefty price for instant approval online? Online lenders take advantage of inefficiency in the traditional loan market by offering business owners same day approvals in exchange for extraordinarily high APRs.

Without a faster pathway to success, small businesses are accepting incredibly high-interest rates from what appears to be fast and easy online sources of capital. Meanwhile, community-based lenders are losing market share and finding it increasingly difficult to be seen in the sea of information online. Solving for this inefficiency is foundational for lenders who pride themselves on providing high-quality products to small business over the long term.

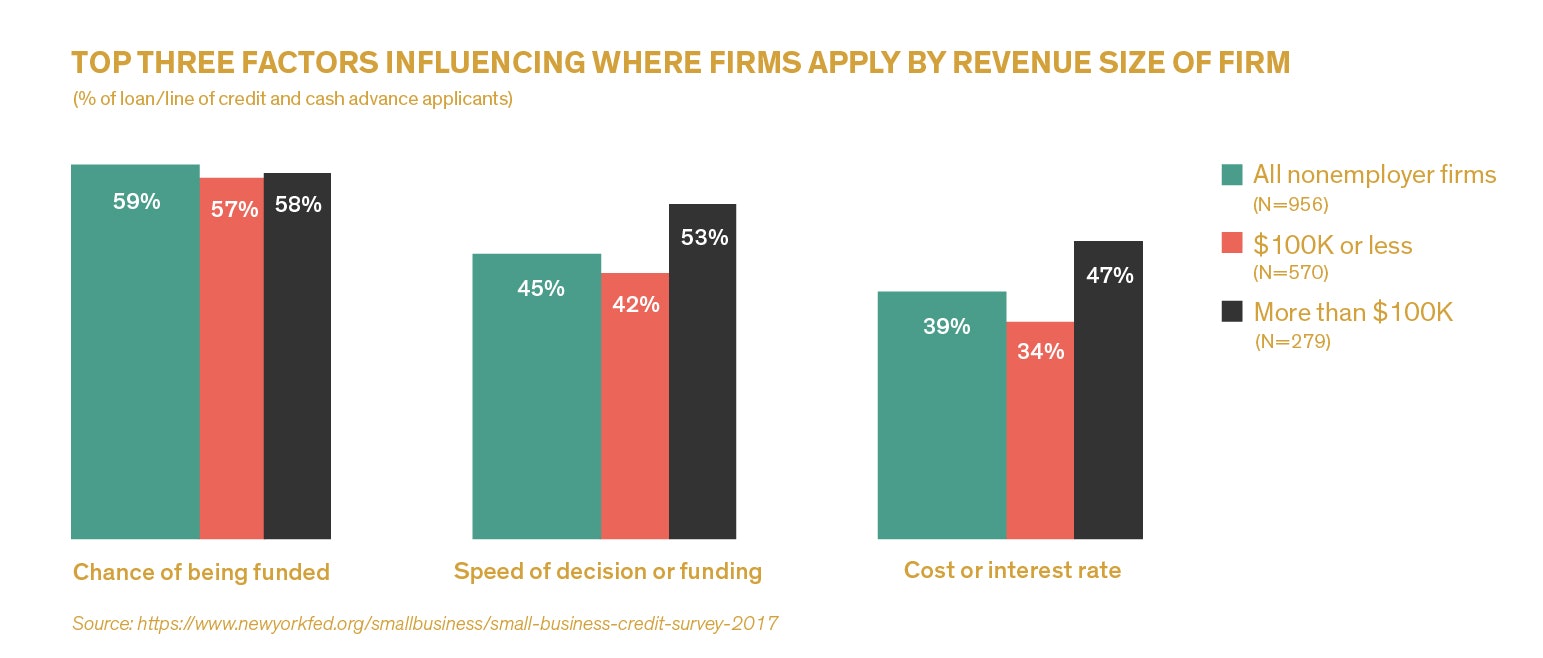

The 2017 Small Business Credit Survey by the Federal Reserve Banks of New York, Cleveland, and Richmond, found that the speed to funding was the second most important factor affecting where firms of all sizes apply for loans–more important than even the cost of the loan. In addition, over half of all businesses surveyed reported difficulty with application processes and transparency issues. Application clarity and process transparency are key to customer satisfaction and building trust. In a world where all industries are leveraging technology to create greater simplicity and transparency, solutions for these challenges are quickly becoming table stakes even for more traditional lenders.

Gone are the days of clunky enterprise software that feels more like a spreadsheet than an assistant. At Lenderfit, we’ve prioritized user experience from day one in an effort to create a solution that is as useful as possible. If it’s not possible to sit down with a new software solution and achieve a basic level of operational proficiency without formal training, it will deplete valuable time and money. The same applies to front-end customer engagement. When customer portals are not modernized or do not exist at all, lenders face major credibility and efficiency issues.

At Lenderfit, we solve for speed, opportunity, and transparency with a well-designed interface that combines automation and personalization. We help lenders meet small business where they are. Small teams, new projects, and varying skill sets mean borrowers require a nimble product to ensure they stay engaged and not frustrated. In addition to email, Lenderfit is the only lender platform with robust SMS communication tools. With read rates of 82% in the first 5 minutes for SMS, it’s essential that Lenders have a way to send and record text messages with busy small business owners. Self-updating checklists provide applicants with a pathway to success while helping to uncover questions and roadblocks earlier in the process!

“Gone are the days of clunky enterprise software that feels more like a spreadsheet than an assistant.”

At Lenderfit, we exist to help lenders grow their portfolio of satisfied borrowers and accomplish their mission with tools they’ll love to use and their clients have grown to expect. At the end of the day, lenders want each borrower to have a great experience and to feel both encouraged and supported through the process. Lenderfit is an intuitive and well-designed tool to ensure both lender and borrower have the information they need to quickly move forward. If you’d like to learn more about our customizable software solution, we’d love to hear from you.