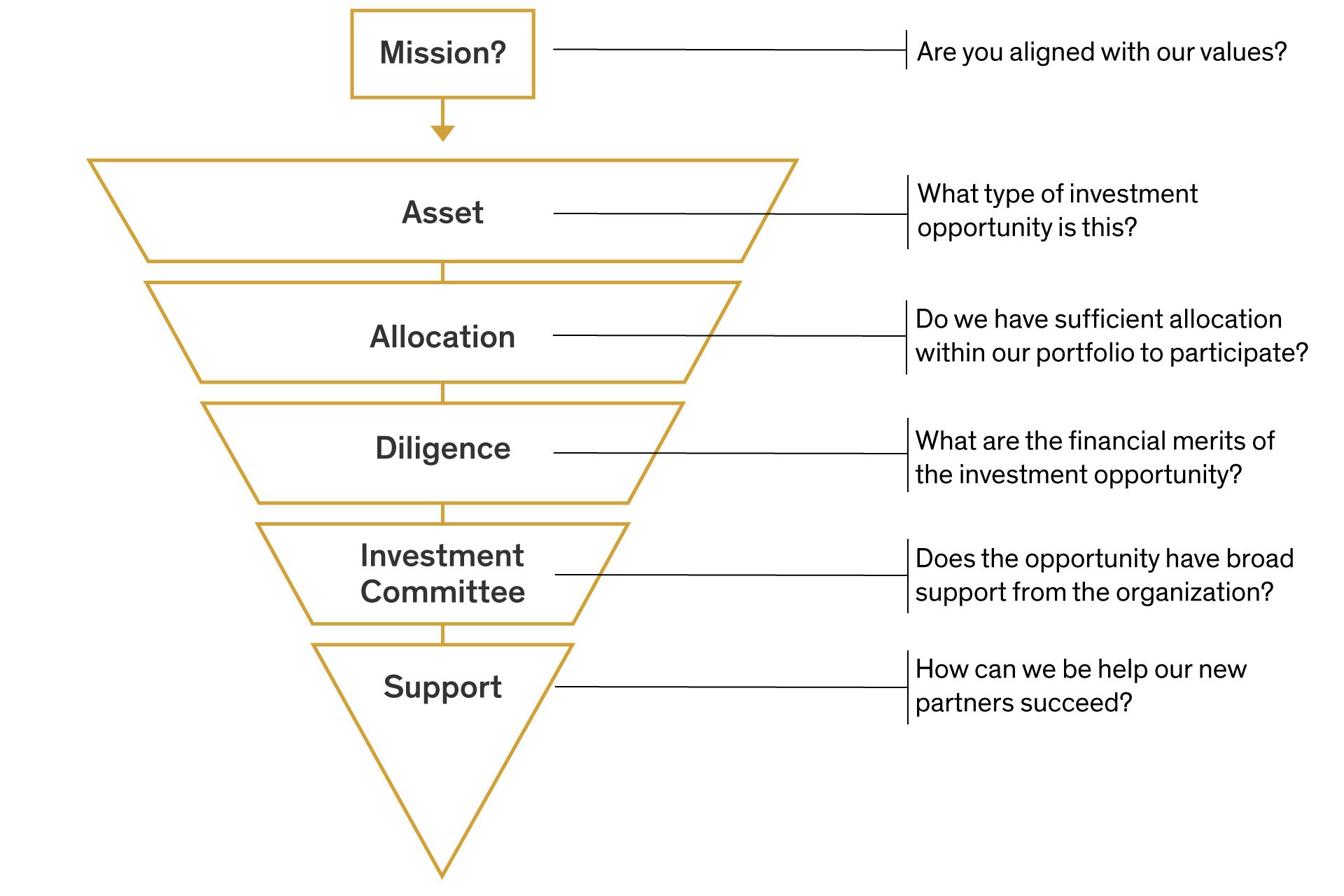

How We Make Investment Decisions

Given our commitment to impact investment, we are often asked about our process of decision making. People tend to wonder if social return and financial return come into conflict. The simple answer is: Yes. However, a clear understanding of our organization’s goals acts as an effective mediator in this conflict.

So how do we make investment decisions?

The goal of this post is to describe our process in a linear fashion. There are certainly exceptions to the process, but it serves as a guidepost for decisions. If you are curious about our overall view on investment, you may enjoy our long-form article on one-pocket investing.

Value Alignment

From the start, we evaluate whether or not an investment opportunity is in line with our core values. One may think this is a binary review, however, most opportunities are not “for” or “against” our values. There is a large middle ground we refer to as “neutral” opportunities that may serve as important capital placements towards our goal of sustainability.

It is important to know that many opportunities require a materiality threshold during this review process as the core business may be positively aligned or neutral to our values, with an immaterial amount of revenue coming from activities that may be negatively aligned. For example, if you have an anti-firearm position will you remove Walmart from your portfolio because they offer hunting rifles at some locations? Perhaps, it would depend on the relative value of gun control within your organization.

This step requires a firm understanding of your values and an open mind to navigate its complexity.

Financial Alignment

Most people we speak with consider this to be the most challenging aspect of the investment decision process. That’s understandable as it requires more review and technical knowledge, but the complexity is far less than determining value alignment.

Step 1: Asset Definition

The first step in determining financial alignment is to classify the opportunity into an asset category. Each asset class has its own financial characteristics that play a crucial role in the construction of a portfolio.

Access Ventures broadly uses the following categories:

– Cash and Cash Equivalents

– Fixed Income

– Public Equities

– Real Assets

– Alternative Investments

– Private Investments

Step 2: Portfolio Allocation Review

Once we determine the asset class, we immediately review whether or not we have an available allocation to that class. If we don’t then we are more than likely to forgo participation in order to maintain our strategic portfolio balance.

Step 3: Diligence

If we do have room within the portfolio we will move into the diligence phase of investment, which is simply a deeper review of the opportunity. Our diligence process resembles that of many traditional investment firms and is highly dependent upon the type of investment and its structure.

At a high level, we are seeking to understand if the opportunity offers a financial return in line with the risk associated with it. There are many aspects of this review, such as industry and innovation review, competitive landscape analysis, etc. One aspect of particular interest to us at Access Ventures is a review of the team behind the opportunity. We have written on this topic in the past, as we often hear people share their desire for aligned capital.

Step 4: Investment Committee Approval

Depending upon the circumstances, Access Ventures leans on its Investment Committee to make the final decision on an investment opportunity. This step provides additional prudence in the decision-making process and holds the organization accountable to its investment mandate.

Where many firms stop with approval, we continue our process to understand how to best support our new partners. Although we would love to meet all of their needs, we have learned that we best support others through storytelling, network sharing, and being a user-owner.

Step 5: Ongoing Support

Where many firms stop with approval, we continue our process to understand how to best support our new partners. Although we would love to meet all of their needs, we have learned that we best support others through storytelling, network sharing, and being a user-owner.

Our storytelling efforts strive to humanize what may often feel distant. One example would be our Five Questions series where we highlight the expertise of our partners. Another example would be our Founder’s Stories, where we help the team share what they do and why they believe it’s important for the world.

Over time we have grown close with many other firms in our industry and related industries. Time and again our investment partners have enjoyed access to our network to test their idea, add new investors, create profitable joint ventures, and more.

Access Ventures considers itself “user-owners” because once we make our investment we begin to use the product or service when possible. For example, when we first invested in Ethic we committed to act as beta-users of their new investment platform. Over time a small portion of our public equities portfolio has grown into the majority our this asset class being managed by Ethic.

Continuous Improvement

Over time our decision-making process has evolved to be more inclusive, effective, and efficient. This evolution is not by accident as we regularly assess the process for areas where it may be improved.

A core value of our organization is growth and humility. We recognize that we do not know everything and we are open to feedback. If you have thoughts on how we can improve, please let us know!