Demystifying Blockchain Adoption

“For something to be adopted and widely accepted, it needs to be 10x better than the existing experience.” – Joey Krug, CIO Pantera Capital

What drives adoption? That’s a question the blockchain industry is asking itself as the euphoria around the technology’s potential fades into the background and companies face the challenge of building tangible value to attract users. But perhaps that is the wrong question. Given the state of the technology, we may need to ask ourselves what are the barriers to adoption?

What is “Adoption”?

The definition of adoption is “the action or fact of choosing to take up, follow, or use something.”

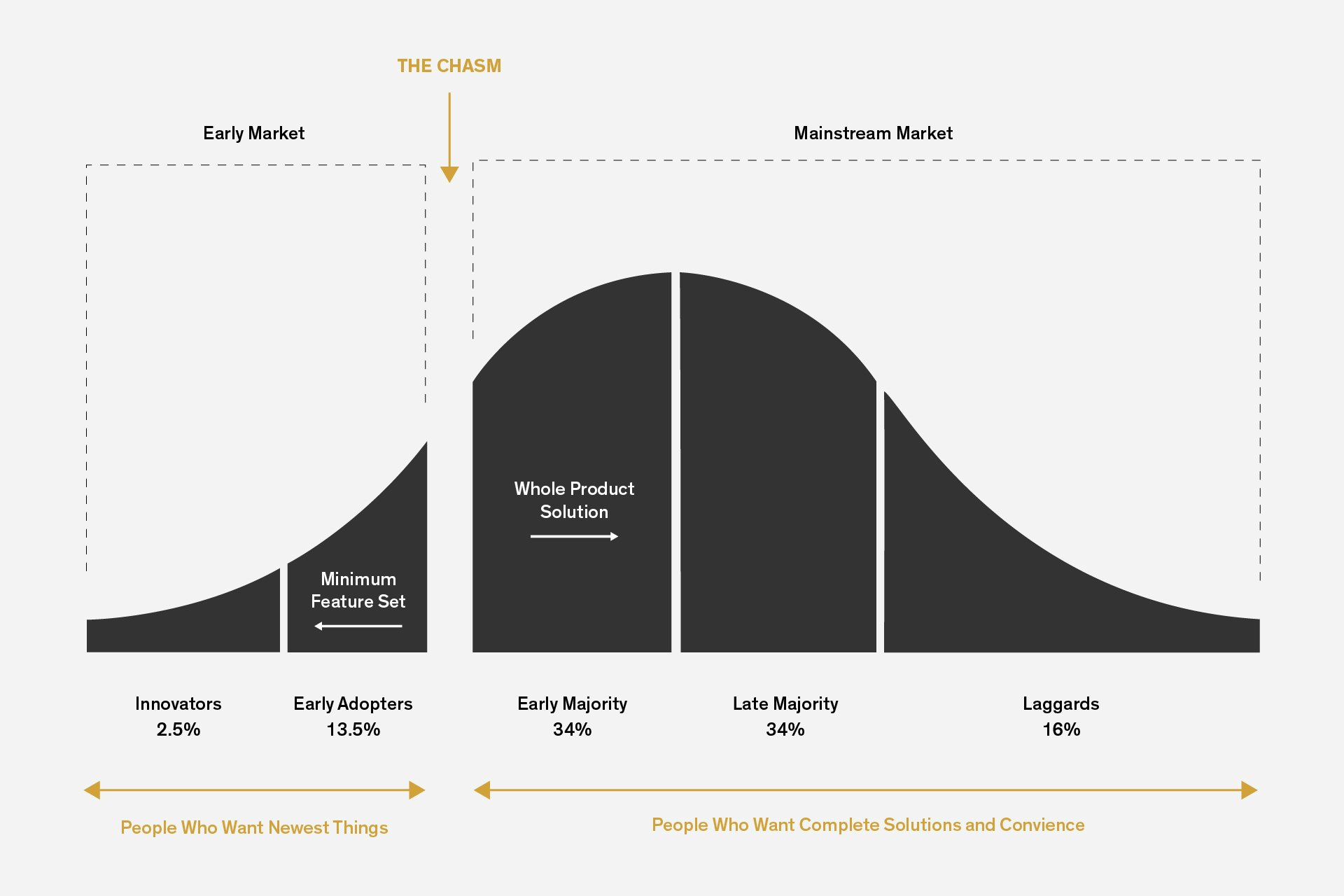

In the context of new technologies, the standard way to think of adoption references the Diffusion Process, more commonly known as the “Rogers Adoption Curve.” The idea is that adoption happens in a linear fashion, working its way through five personas:

- Innovators

- Early Adopters

- Early Majority

- Late Majority

- Laggards

One thing to note is that “blockchain technology” can encompass many different innovations (protocol, middleware, applications) which may progress through the phases of adoption independently. For example, Bitcoin as a protocol may be in the Early Majority while Cryptokitties as an application remains with Innovators.

Barriers to Adoption

This section borrows heavily from Joey Krug, CIO of Pantera Capital and Co-Founder of our portfolio company Beam, and his thoughts from “A Crypto Thesis.” If you have time I would highly encourage reading the full thesis.

When I think of barriers to mainstream adoption, I think of three main categories: Technical, Financial, and Behavioral. Each category has numerous subcategories and respective communities of vested individuals working on solutions.

Technical barriers

Significant computer science problems must be solved before we can effectively deploy scalable blockchain technology. The most pressing barriers to scalability have to do with the sheer fact that ledgers must update instantly and seamlessly across a distributed network of nodes across the world. Due to the size of the ledgers achieving instantaneous propagation is difficult.

The race to resolve these difficult computer science problems is further complicated by the reality that, unlike existing technologies, which have scores of coding tools that make new products quicker, easier, and cheaper to develop, programming tools and repositories within the blockchain space are still in their infancy.

Financial barriers

One major advantage of blockchain technology is that it enables a new financial system to exist; a financial system that opens access to the economy and allows anyone to participate to the fullest measure. However, in order to sustain a new financial system, there must be sufficient capital (or liquidity) to enable trading.

One significant barrier to liquidity for this new financial system is the fact that it’s difficult and expensive to place capital and transact within it because of clunky capital on-ramps that charge a fee for conversion of fiat to the underlying cryptocurrency of choice and restrict the free flow of capital necessary to manage risk. This reality restricts the ability of large sums of capital to flow into the space. Although some measures of market capitalization show over $100 billion in the system already, that’s a far cry from $21 trillion in the S&P 500.

Another significant barrier to liquidity is the lack of qualified custody options for institutions placing capital into the market. The SEC requires investment advisors to place client funds with a separate institution that is skilled at safeguarding and reporting on those assets. The custody rule is designed to protect against theft or misappropriation, which is doubly important yet more complicated for digital assets which face more intense and irrevocable security threats.

One major advantage of blockchain technology is that it enables a new financial system to exist; a financial system that opens access to the economy and allows anyone to participate to the fullest measure.

Behavioral barriers

One of the greatest barriers to adoption of blockchain technology is crossing the chasm from “early adopter” to “early majority,” which will require people to try new things. This is a critical step in adoption as this tips favor towards the new technology as nearly half of a given population prefers it over the alternatives.

Clunky user experiences, which are consequences of design and technical barriers that plague the space, are the biggest and most obvious examples of behavior problems. It is difficult to get people to try something new. It is doubly so when that thing comes with an un-intuitive and clunky experience. As users, we live in a world where applications need to load in under three seconds otherwise our attention wanes. An indirect analog for blockchain technology may be the time it takes for a transaction to settle, which in the case of Bitcoin is estimated at 78 minutes and a speedy 6 minutes for Ethereum. This analog may be indirect, as most user experiences are typically built at least one layer above the native blockchains, but it is representative. It certainly impacts the ability of developers to build seamless user experiences.

Until user experiences can meet present-day consumer expectations, adoption will require users to adjust their preferences in order to gain the underlying benefit of blockchain technology. This means that overcoming behavioral barriers to adoption requires that either the value proposition is so compelling that users gladly tolerate “a bit of clunk,” or, more likely, that resolution to the technical and design problems plaguing blockchain technologies paves the way to more seamless user experiences.

We expect to see solutions to the technological, financial, and behavioral barriers come online in the next few years. It’s helpful to remember that blockchain technology is only ten years old with progressive innovations coming to market at an impressive rate. And while we wait for new solutions we look forward to growing alongside other early adopters and promoting use cases that build a more inclusive economy.